When you move out for higher studies, there are so many hurdles out of the way now. Before you start earning, there is another hurdle waiting for you, researching an excellent Irish bank to manage your finances. One of the essential things that I tried to figure out in the first month was getting an Irish student’s bank account.

Having an Irish bank account in Ireland allows you to manage your finances hassle-free. Especially when we carry limited funds while travelling and for most of the students who are on a student loan need to disburse their further loan, an Irish bank account is essential and beneficial.

I cannot help you with any of your other problems, but I have made the process a bit easier. Here are the top 3 Irish banks for an international student.

Like any other business, banks also lure you in with ‘freebies’ so that you get enticed by them and stay loyal customers, especially with students because they are potential lifelong customers. Carefully select the bank that treats you well for the whole time you are with them and not only till you are a student.

Here’s a list of the top 4 Irish Banks For Students:

AIB – Allied Irish Bank

AIB offers the most reliable accounts for a student. This is by far the best Irish bank as it offers everything a student could require, especially the €3,000 per year Contribution Charge Loan with interest-free overdraft that is a massive support to all the students who are struggling to cover their college fees. Another Student loan that the bank offers with the Student Plus Account is €50,000 with an interest rate of 8.45%It also offers more credit to students than any other bank which is very important with rent and registration fees.

It also offers a mobile app and contactless payments. It also has a variety of insurance policies and has 200 branches throughout Ireland as well as offices in the United Kingdom and the United States.

They are so helpful and will guide you at every step if there’s any difficulty. Once my money got stuck because of my mistake, I contacted them, and the issue was solved within minutes. They guided me well and were great assistance.

I would recommend you all to check out all the details of AIB, and then if it suits you, you should definitely go for it.

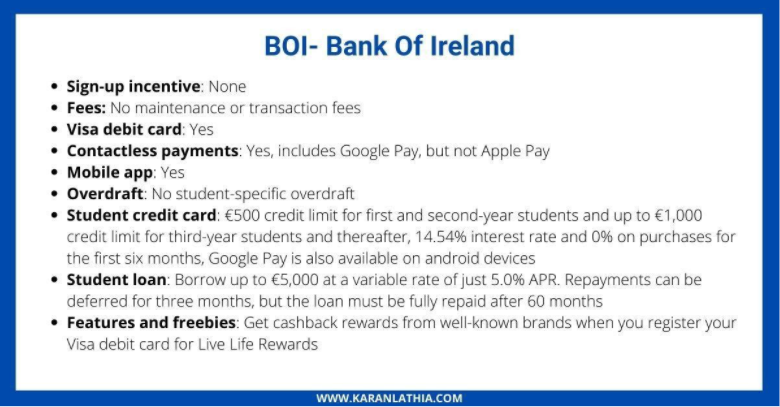

Bank Of Ireland

Bank of Ireland is Ireland’s largest bank and offers a good fee-free and full of the feature’s student account. There is no student overdraft, but you can opt for a Student Mastercard with a reasonable interest rate and interest-free purchases for the first six months. You can take a loan of €5,000 at 5% APR that needs to be repaid after 60 months. With the Live Life Rewards, you can get cashback from well-known brands after registering your Visa Debit Card.

You should look at their official website and check out some more deals and offers as they have many things to offer. I’m sure you will find something that’s helpful for you.

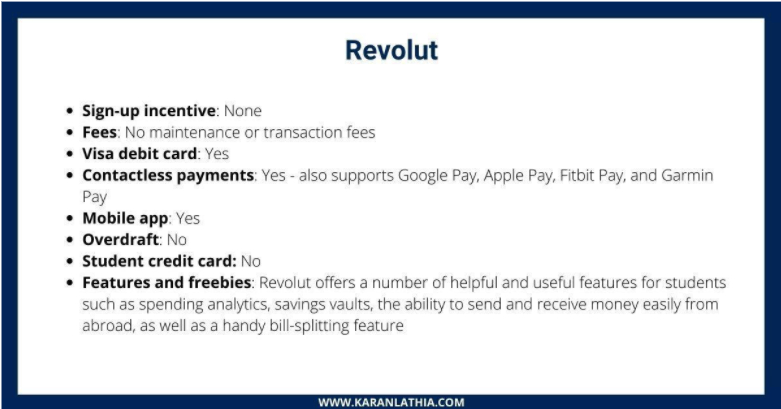

Revolut

It’s a very user-friendly mobile application, so the number of users is increasing day by day. There are so many different features that will make your financing so easy. You can set a limit, and your money will automatically get into the saving vault.

There are also many investment options with a decent margin. You can get a debit card without any external fee. The transfer of money to different currencies is convenient and quick with Revolut.

I personally find this application so valuable and so easy to use. You should indeed check it out and make a decision if you are willing to go with it or not.

Conclusion

These three Irish bank accounts are the ones that I either used or have my connections using primarily, and only after researching would I recommend something essential like a bank. KBC is online banking, while the other banks offer both online as well as offline banking.

Managing everything on your own is scary but does not have to be complicated. Ireland has many banks that have a lot of student-friendly accounts and are very easy to use. Comment below if you think my list needs to be updated. Thanks for reading, and I hope you have a good day.

If you want to know more about Ireland and need some useful tips and travel itineraries, head on to my blog, and click here.

Note:

Please refer to all the terms and conditions from the bank’s official source itself before deciding anything, as they might change their policies.

If You Have Any Query Or Doubts